Firm News & Updates

KWC Names New Principals

We are pleased to announce that John Hall, Shelley Hyde and Amanda Ramsey have been named Principals with the firm. “John, Shelley and Amanda represent the firm's next generation of leaders,” said Connie Hammell, Managing Principal of KWC. “They have consistently...

8 Life Events That May Change Your Tax Situation

Life is full of changes, and many significant milestones can affect your tax situation in unforeseen ways. Whether you're getting married, welcoming a new child, starting a new job or making other changes, it's important to understand how these events can affect your...

KWC Update: Service Discontinuation for QuickBooks Desktop 2022

Intuit recently announced service discontinuation for QuickBooks Desktop 2022. Below is additional information regarding the discontinuation and how it may affect you as a current user. When will service discontinuation begin (and the products affected)? After May...

Business Owners: Is It Time to Transition Ownership to the Next Generation?

One of the upsides to owning a small business is the chance to provide a financial legacy for your family members to participate in after you exit the business. However, there are federal tax implications to transferring ownership to your loved ones. Whether you're...

Tax Options for Vacation Home Owners Who Want to Sell

In many areas, vacation home prices have skyrocketed, along with property insurance costs. If you own a highly appreciated vacation property, is it time to cash out and simplify your life? You could simply sell the property and accept the tax hit on your gain. (See...

8 Red Flags That Could Trigger an IRS Audit

Keeping up with ever-evolving tax laws can be challenging for individuals and small business owners. Because the IRS continuously refines its systems for detecting errors and inconsistencies, it's important to understand potential audit triggers — and how to avoid...

The Lowdown on 401(k) Plan Catch-Up Contributions

How big is your retirement nest egg? Too often, people sacrifice retirement savings to afford a bigger home, cover emergency expenses or pay for their children's education. But time flies, leaving many retirees "financially fragile." In fact, only half of today's...

Dispelling 10 Federal Tax Myths and Misconceptions

In the complex world of federal taxes, myths and misconceptions can lead to costly mistakes and missed opportunities — especially for business owners and high-net-worth individuals. Here's a look at 10 tax myths that, if left unchecked, may limit tax breaks and...

Treasury Ends the Enforcement of Beneficial Ownership Information Reporting for Certain U.S. Citizens and Domestic Companies

The Treasury Department announced on March 2, 2025, that it won’t enforce penalties or fines relating to Beneficial Ownership Information (“BOI”) reporting under existing regulatory requirements. For US citizens or domestic reporting companies or their beneficial...

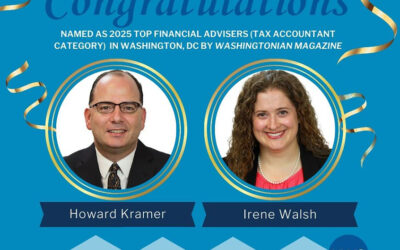

KWC Principals Named Top Financial Advisers

KWC is pleased to announce that Howard Kramer and Irene Walsh have been named as 2025 Top Financial Advisers (Tax Accountant category) in Washington, DC by Washingtonian Magazine. Howard Kramer is a Principal at KWC. Howard has more than 20 years of experience...